Condo Insurance in and around Springfield

Looking for great condo unitowners insurance in Springfield?

Condo insurance that helps you check all the boxes

- Ludlow

- Bellows Falls

- Rutland

- Brattleboro

- Claremont

- Walpole

- West Lebanon

- Hanover

- Springfield

- Keene

- Londonderry

- Windsor

- Chester

Home Is Where Your Condo Is

There is much to consider, like coverage options deductibles, and more, when looking for the right condo insurance. With State Farm, this doesn't have to be a complicated decision. Not only is the coverage remarkable, but it is also surprisingly well priced. And that's not all! The coverage can help provide protection for your condominium and also your personal property inside, including things like appliances, mementos and shoes.

Looking for great condo unitowners insurance in Springfield?

Condo insurance that helps you check all the boxes

State Farm Can Insure Your Condominium, Too

It's no secret that life is full of surprises, which is all the more reason to be prepared for the unexpected with condo unitowners insurance. This can include instances of liability or covered damage to your condominium from a tornado, a hailstorm or theft.

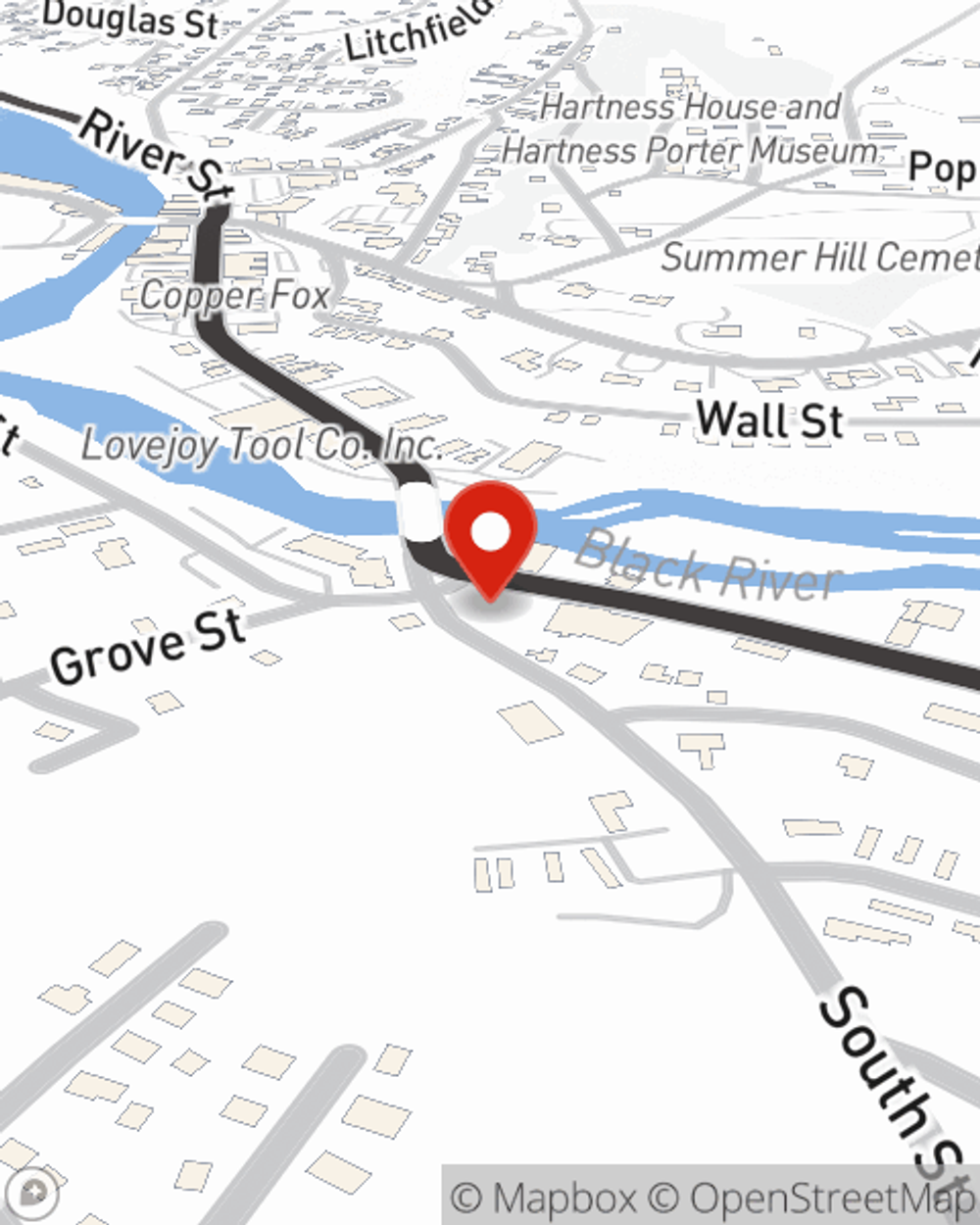

That’s why your friends and neighbors in Springfield turn to State Farm Agent Jerry Farnum. Jerry Farnum can walk you through your liabilities and help you find the most appropriate coverage for you.

Have More Questions About Condo Unitowners Insurance?

Call Jerry at (802) 885-2939 or visit our FAQ page.

Simple Insights®

Do you need a real estate agent to buy a house?

Do you need a real estate agent to buy a house?

While it's possible to buy or sell a house without a realtor, there are advantages that you shouldn't discount because you think it will save money.

Should you DIY your move or hire someone?

Should you DIY your move or hire someone?

Moves can vary in price — and effort. We walk you through your options, from DIY to full-service professional movers, and provide recommendations for when to opt for each.

Jerry Farnum

State Farm® Insurance AgentSimple Insights®

Do you need a real estate agent to buy a house?

Do you need a real estate agent to buy a house?

While it's possible to buy or sell a house without a realtor, there are advantages that you shouldn't discount because you think it will save money.

Should you DIY your move or hire someone?

Should you DIY your move or hire someone?

Moves can vary in price — and effort. We walk you through your options, from DIY to full-service professional movers, and provide recommendations for when to opt for each.